Administrators in the field of taxation

Do you have experience in direct or indirect taxation? Would you like to start an international career within a multicultural and diverse team? If yes, then read on.

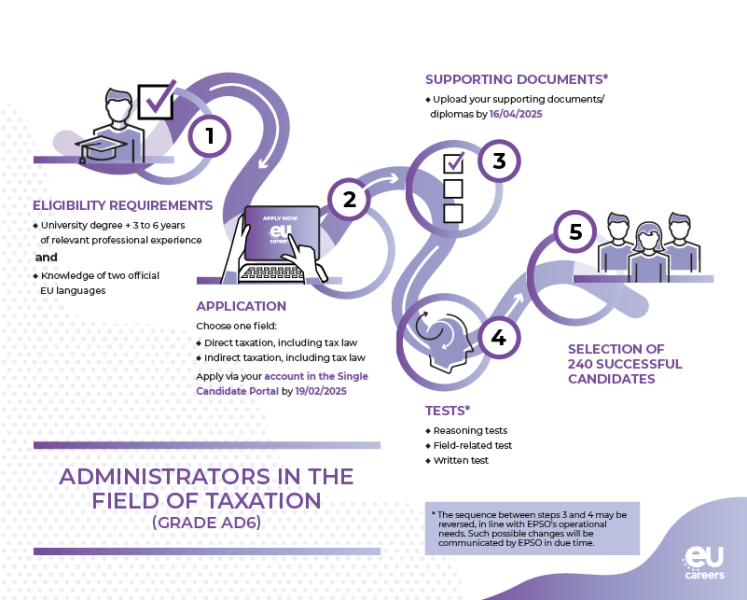

The EU institutions are looking for professionals in two different fields: direct taxation and indirect taxation, including tax law. Successful candidates will be recruited as administrators, grade AD 6.

Your main tasks will vary depending on the chosen field. Please note that you may only apply for one of the following fields:

- Field 1 – Direct taxation, including tax law

Your main tasks may include one or more of the following: developing, implementing, and evaluating policies and legislation in direct taxation; assessing tax legislation in EU Member States and third countries (i.e., countries outside the EU); examining inquiries, complaints, and petitions on direct taxation issues; preparing legal opinions and documents for court and arbitration proceedings; managing infringement procedures; enforcing State aid rules; facilitating legislative proposals, information exchange, and IT tool coordination with Member States; representing and negotiating internationally on direct taxation matters; carrying out political/policy, legal, or scientific analyses; managing budgets and projects related to direct taxation.

- Field 2 - Indirect taxation, including tax law

Your main tasks may include one or more of the following: developing, implementing, applying, and evaluating policies and legislation in indirect taxation; enforcing State aid rules in indirect taxation; examining inquiries, complaints, and petitions related to indirect taxation; preparing legal opinions and managing infringement procedures; planning, carrying out, and following-up VAT inspections in Member States and related tasks; coordinating, negotiating, and representing interests at the international level; carrying out policy, legal, and scientific analysis, advising, and translating technical insights into relevant measures; managing budgetary, financial, and accounting aspects, and overseeing projects in indirect taxation.

Detailed information on the specific duties that successful candidates can expect to perform is included in the Notice of Competition (see Annex II – Typical duties).

For detailed information on requirements, please read the Notice of Competition on our apply pages below.

The application period is now open and ends on 19 February 2025, at 12.00 (midday), Brussels time.